Are you tired of delayed transactions and account restrictions due to outdated KYC? Upholding KYC norms is mandatory and crucial to ensure a secure financial ecosystem. Banks require customers to keep their KYC up-to-date to avoid any suspicious activities and potential frauds. So, if you haven’t updated your KYC in a while, it’s time to act quickly.

In this article, we’ll guide you through the KYC update process in Indian banks, and share with you sample forms for different banks. We’ll also explain why KYC updation is important and the benefits it provides. Whether you’re an individual or a business account holder, this guide is for you. Furthermore, we’ll provide answers to common questions and give you tips to avoid making common mistakes that can cause delays in the KYC update process.

By the end of this article, you’ll have a clear understanding of how to comply with KYC regulations and complete your KYC update with ease. So, let’s get started!

Contents

- 1 Sample Request Letter to Bank for KYC Update

- 2 Application for KYC in bank in English Example

- 3 KYC letter format for bank sample

- 4 How to write application for KYC in bank

- 5 Sample Application letter for KYC update in SBI Bank

- 6 Application for KYC Update in Bank in Hindi

- 7 What is KYC Update in Bank

- 8 Application for KYC Update in Bank Format

- 9 FAQs

Sample Request Letter to Bank for KYC Update

To,

The Branch Manager,

[Bank Name],

[Branch Address],

[City],

[Pincode]

Subject: Request for KYC update

Respected Sir/Madam,

I am [Your Name], account holder of [Bank Name] with account number [Your Account Number]. I am writing this letter to request you to update my KYC details in your records.

The reason for this request is that my address has changed recently, and I want to ensure that my current address is updated in my bank account records so that I can receive important account-related information on time.

I have attached all the necessary documents, such as my updated address proof (copy of the latest electricity bill), PAN card, and Aadhaar card for verification. I kindly request you to initiate the KYC update process at the earliest possible time.

Thank you for your attention to this matter.

Sincerely,

[Your Name]

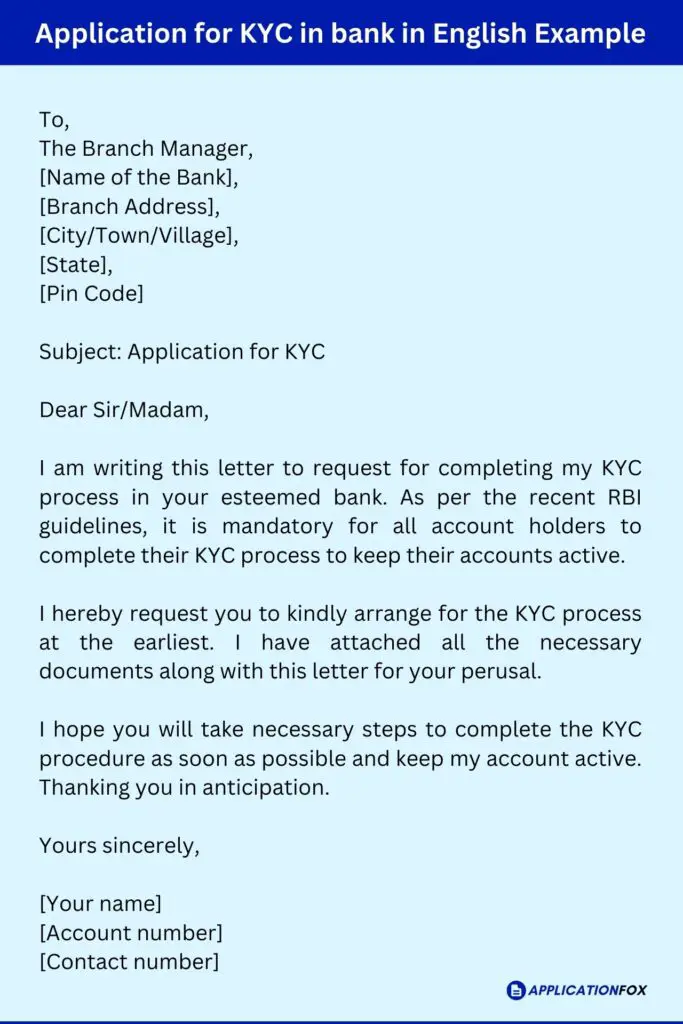

Application for KYC in bank in English Example

To,

The Branch Manager,

[Name of the Bank],

[Branch Address],

[City/Town/Village],

[State],

[Pin Code]

Subject: Application for KYC

Dear Sir/Madam,

I am writing this letter to request for completing my KYC process in your esteemed bank. As per the recent RBI guidelines, it is mandatory for all account holders to complete their KYC process to keep their accounts active.

I hereby request you to kindly arrange for the KYC process at the earliest. I have attached all the necessary documents along with this letter for your perusal.

I hope you will take necessary steps to complete the KYC procedure as soon as possible and keep my account active. Thanking you in anticipation.

Yours sincerely,

[Your name]

[Account number]

[Contact number]

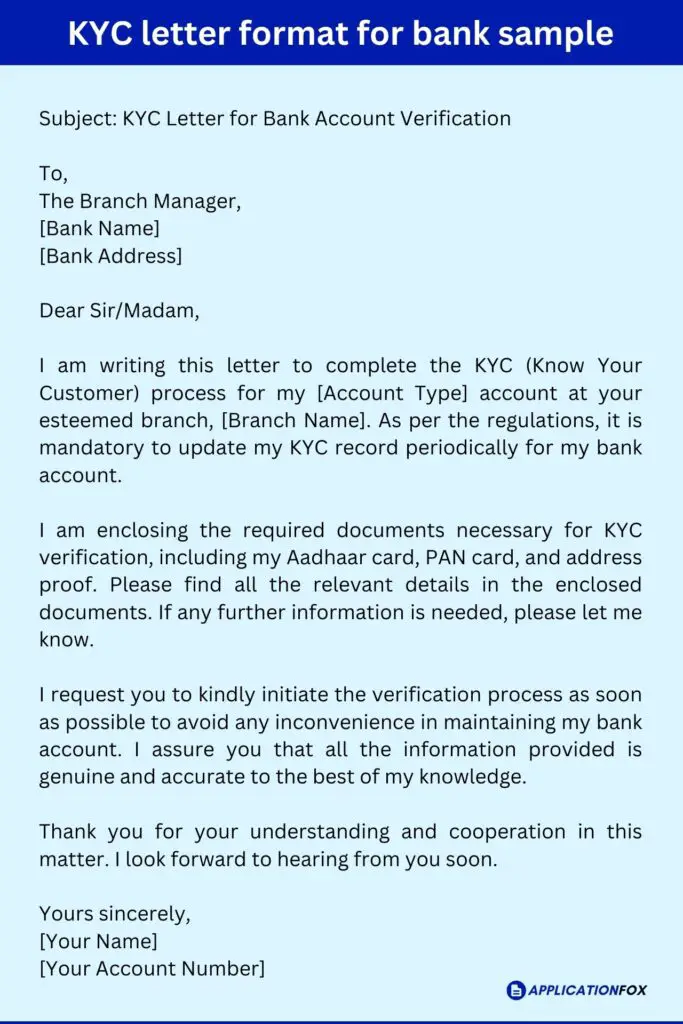

KYC letter format for bank sample

Subject: KYC Letter for Bank Account Verification

To,

The Branch Manager,

[Bank Name]

[Bank Address]

Dear Sir/Madam,

I am writing this letter to complete the KYC (Know Your Customer) process for my [Account Type] account at your esteemed branch, [Branch Name]. As per the regulations, it is mandatory to update my KYC record periodically for my bank account.

I am enclosing the required documents necessary for KYC verification, including my Aadhaar card, PAN card, and address proof. Please find all the relevant details in the enclosed documents. If any further information is needed, please let me know.

I request you to kindly initiate the verification process as soon as possible to avoid any inconvenience in maintaining my bank account. I assure you that all the information provided is genuine and accurate to the best of my knowledge.

Thank you for your understanding and cooperation in this matter. I look forward to hearing from you soon.

Yours sincerely,

[Your Name]

[Your Account Number]

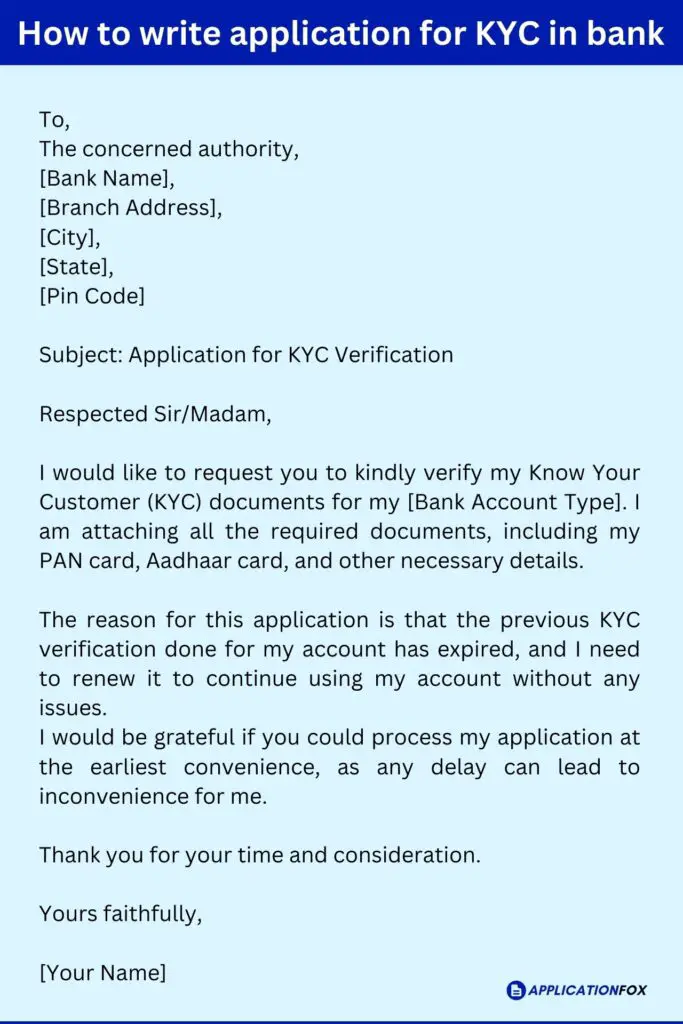

How to write application for KYC in bank

To,

The concerned authority,

[Bank Name],

[Branch Address],

[City],

[State],

[Pin Code]

Subject: Application for KYC Verification

Respected Sir/Madam,

I would like to request you to kindly verify my Know Your Customer (KYC) documents for my [Bank Account Type]. I am attaching all the required documents, including my PAN card, Aadhaar card, and other necessary details.

The reason for this application is that the previous KYC verification done for my account has expired, and I need to renew it to continue using my account without any issues.

I would be grateful if you could process my application at the earliest convenience, as any delay can lead to inconvenience for me.

Thank you for your time and consideration.

Yours faithfully,

[Your Name]

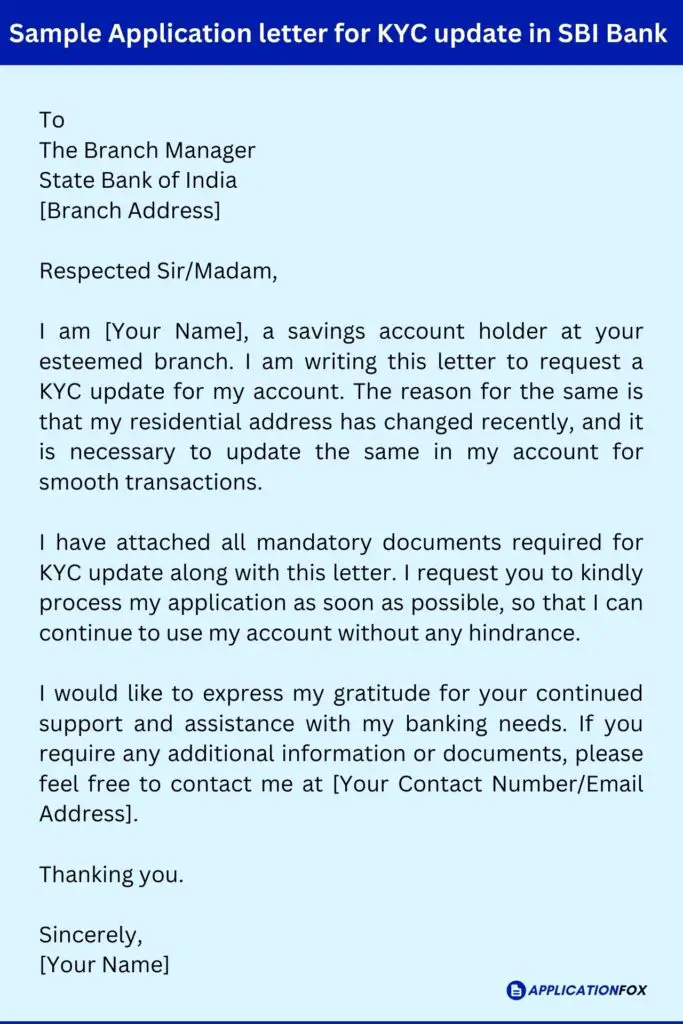

Sample Application letter for KYC update in SBI Bank

To

The Branch Manager

State Bank of India

[Branch Address]

Respected Sir/Madam,

I am [Your Name], a savings account holder at your esteemed branch. I am writing this letter to request a KYC update for my account. The reason for the same is that my residential address has changed recently, and it is necessary to update the same in my account for smooth transactions.

I have attached all mandatory documents required for KYC update along with this letter. I request you to kindly process my application as soon as possible, so that I can continue to use my account without any hindrance.

I would like to express my gratitude for your continued support and assistance with my banking needs. If you require any additional information or documents, please feel free to contact me at [Your Contact Number/Email Address].

Thanking you.

Sincerely,

[Your Name]

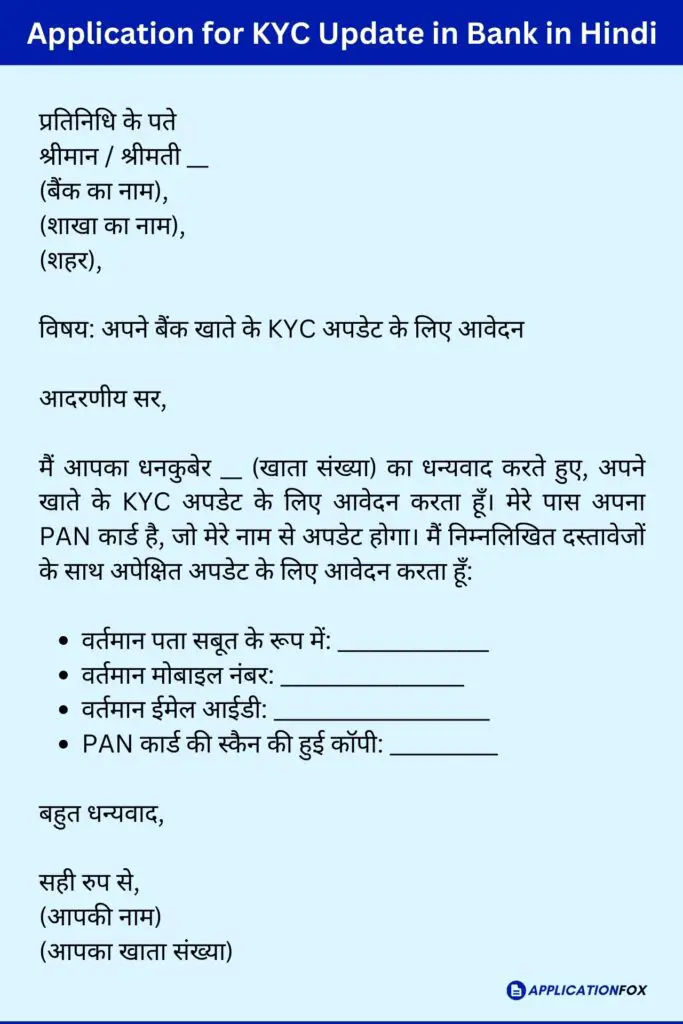

Application for KYC Update in Bank in Hindi

प्रतिनिधि के पते

श्रीमान / श्रीमती __

(बैंक का नाम),

(शाखा का नाम),

(शहर),

विषय: अपने बैंक खाते के KYC अपडेट के लिए आवेदन

आदरणीय सर,

मैं आपका धनकुबेर __ (खाता संख्या) का धन्यवाद करते हुए, अपने खाते के KYC अपडेट के लिए आवेदन करता हूँ। मेरे पास अपना PAN कार्ड है, जो मेरे नाम से अपडेट होगा। मैं निम्नलिखित दस्तावेजों के साथ अपेक्षित अपडेट के लिए आवेदन करता हूँ:

- वर्तमान पता सबूत के रूप में: ______________

- वर्तमान मोबाइल नंबर: _________________

- वर्तमान ईमेल आईडी: ____________________

- PAN कार्ड की स्कैन की हुई कॉपी: __________

बहुत धन्यवाद,

सही रुप से,

(आपकी नाम)

(आपका खाता संख्या)

What is KYC Update in Bank

KYC stands for “Know Your Customer,” which is a process that banks use to verify the identity and address of their customers. KYC updates involve verifying and updating customer information to ensure that their personal and financial details on record are accurate and up-to-date.

Banks are legally required to perform KYC checks on all their customers to prevent financial fraud, money laundering, and other illegal activities. The KYC process typically involves collecting personal information from customers such as their full name, date of birth, address, and proof of identification such as a passport or driver’s license.

KYC updates are essential for banks to keep their customer information current and to comply with government regulations. Banks periodically ask their customers to provide updated information, such as their current address and contact details. Banks may also ask for additional documentation, such as updated ID cards or proof of income.

In summary, a KYC update is a process where a bank checks and updates the personal and financial information of their customers to ensure compliance with government regulations and prevent financial crimes.

Application for KYC Update in Bank Format

Updating your KYC is a crucial task that requires attention to detail in every step. One of the important components of a successful KYC update is the application itself. In this article, we discuss the components that make up a proper application for KYC update in banks and how to structure the application.

Components of a Proper Application

A standard KYC update application has several components that must be completed to ensure a successful update. These components include:

- Personal Information: Personal details such as name, address, date of birth, contact number, email ID, etc.

- Identification Documents: Documents confirming your identity such as Aadhaar Card, PAN Card, Driving License, Passport, and Voter ID. Note that providing multiple ID proofs is mandatory to update KYC.

- Address Verification: Documents that indicate your address such as electricity bills, gas bills, telephone bills, rent agreement, etc.

- Photograph: Recent colored passport size photograph.

Structuring the Application

A well-structured application has the necessary components arranged in a logical order. Here’s a suggested structure for your KYC update application:

- Personal Information: Start with personal details, including the full name, address, date of birth, contact number, and email ID.

- Identification Documents: Provide the relevant identification document numbers followed by their corresponding details such as the issuing authority, issue date, and expiry date.

- Address Verification: Include the necessary address proof documents such as electricity, gas or telephone bills, and rent agreement.

- Photograph: Attach a recent colored passport size photograph.

It’s essential to review and verify that all the information provided is accurate before submitting the KYC update application to the bank.

In conclusion, following these components and structure can help ensure a smooth KYC update in banks. Avoid common mistakes such as submitting incorrect data or incomplete information as these can cause delays and affect the update process. Remember, updated KYC helps keep your account secure and also reduces the likelihood of delayed transactions.

FAQs

How do I update my KYC details in my bank account?

Fill out a KYC update form with your correct details, attach the relevant documents and submit them to your bank branch.

What documents do I need to update my KYC in my bank account?

You may need identity proof, address proof and recent photographs, among other documents specified by your bank.

How long does it take for my KYC update to reflect in my bank account?

It can take up to a few days or weeks depending on the bank’s processing time and the accuracy of your submitted documents.